39 coupon rate calculator for bonds

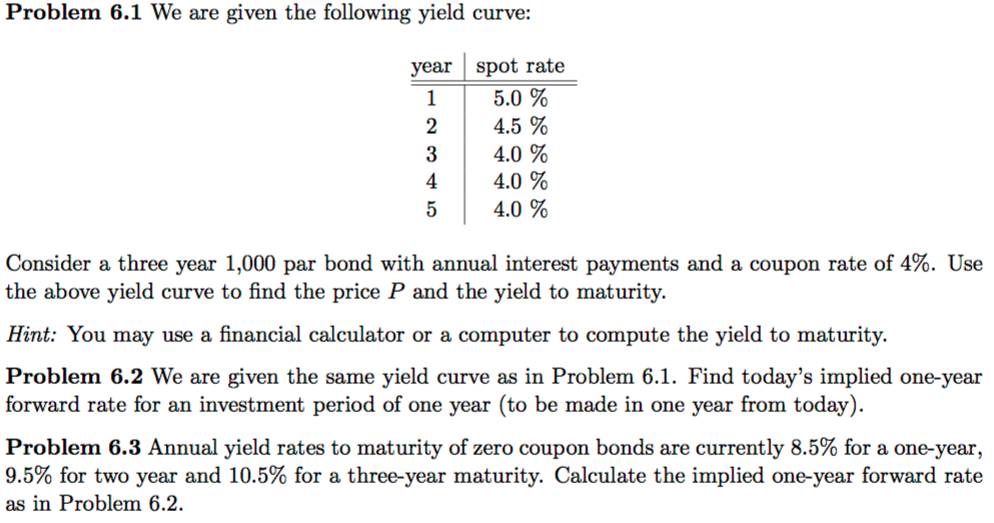

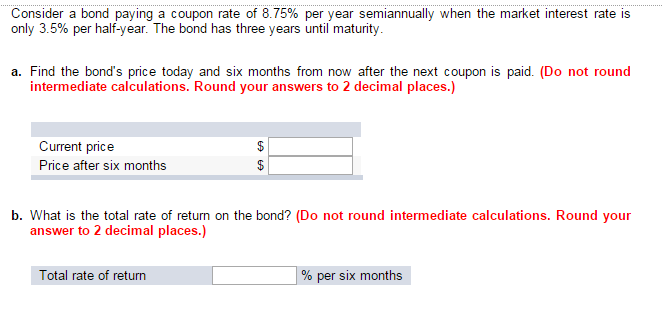

Bond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

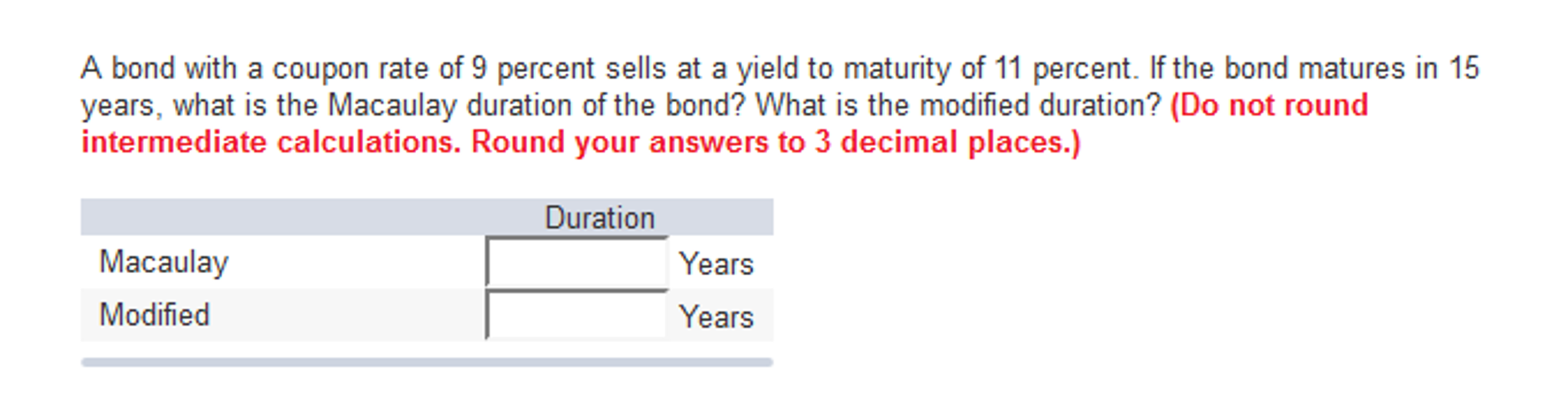

Bond Yield Calculator - Compute the Current Yield - DQYDJ On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula.

Coupon rate calculator for bonds

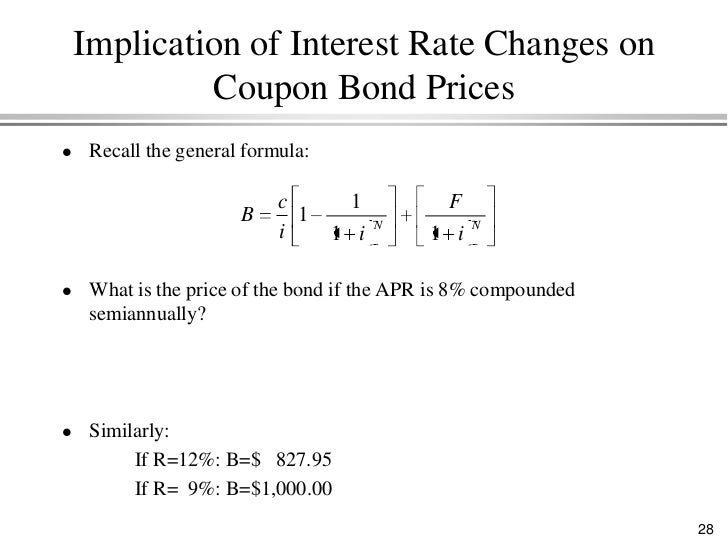

Compound Interest Calculator - Moneychimp Compound interest - meaning that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate - is one of the most useful concepts in finance. It is the basis of everything from a personal savings plan to the long term growth of the stock market. Bond Yield Calculator - CalculateStuff.com In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond Price = current price of the bond. Face Value = amount paid to the bondholder at maturity. Coupon = periodic coupon payment. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon rate calculator for bonds. What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Bond Yield to Maturity Calculator for Comparing Bonds Still, the term persists. The coupon is expressed as a percentage of the bond's face value. So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate ... Bond Yield Calculator Bond's coupon rate (interest rate). The equations that the algorithm is based on are: Current bond yield = Annual interest payment / Bond's current clean price Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ... Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Bond Price Calculator - Belonging Wealth Management Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon payments. Individual - Savings Bond Calculator for Paper Bonds Jan 03, 2022 · To learn the value of your electronic savings bonds, log in to your TreasuryDirect account. Find out what your paper savings bonds are worth with our online Calculator. The Calculator will price paper bonds of these series: EE, E, I, and savings notes. Other features include current interest rate, next accrual date, final maturity date, and ...

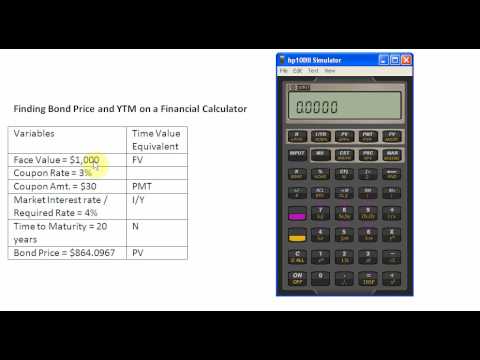

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years.

Bond Yield to Maturity (YTM) Calculator - DQYDJ The calculator internally uses the secant method to converge upon a solution, and uses an adaptation of a method from Github user ndongo. Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes ...

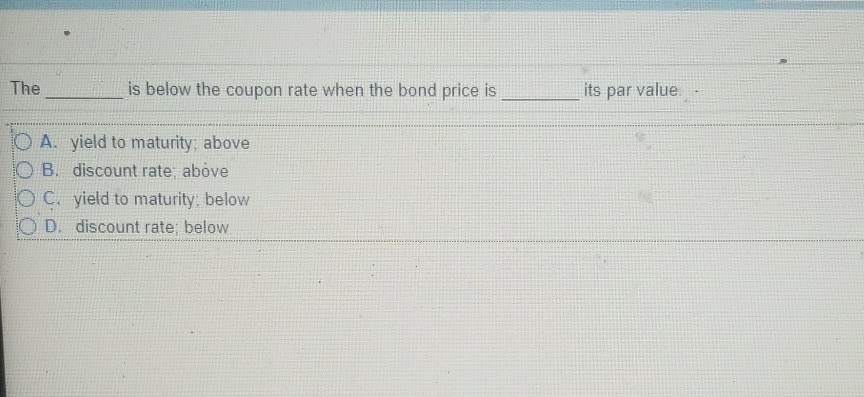

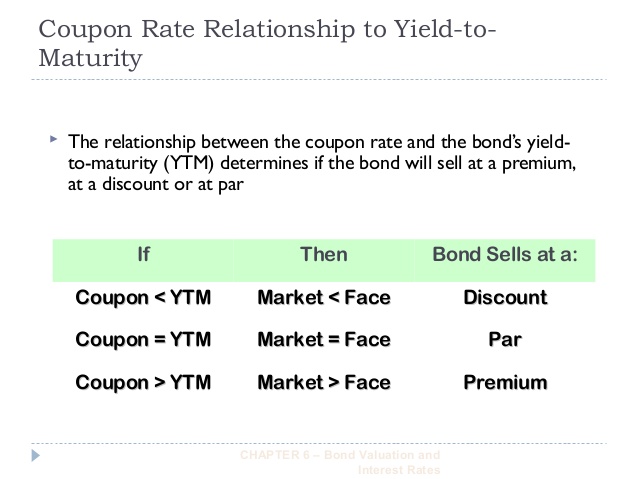

Bond Present Value Calculator Use the Bond Present Value Calculator to compute the present value of a bond. Input Form Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Financial Calculators The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds. Bond Price Field - The Price of the bond is calculated or entered in this field. Enter amount in negative value.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond Example #1. Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%. Popular Course in this category.

What Is a Coupon Rate? How To Calculate Them & What They're Used For Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

Bond Calculator | Calculates Price or Yield Calculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Pricer & YTM Calculator – Calculate Bond Prices and ... This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond.

Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Bond Yield Calculator - CalculateStuff.com In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond Price = current price of the bond. Face Value = amount paid to the bondholder at maturity. Coupon = periodic coupon payment.

Post a Comment for "39 coupon rate calculator for bonds"